CHAPTER 8: Processing Administrative Functions

70

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

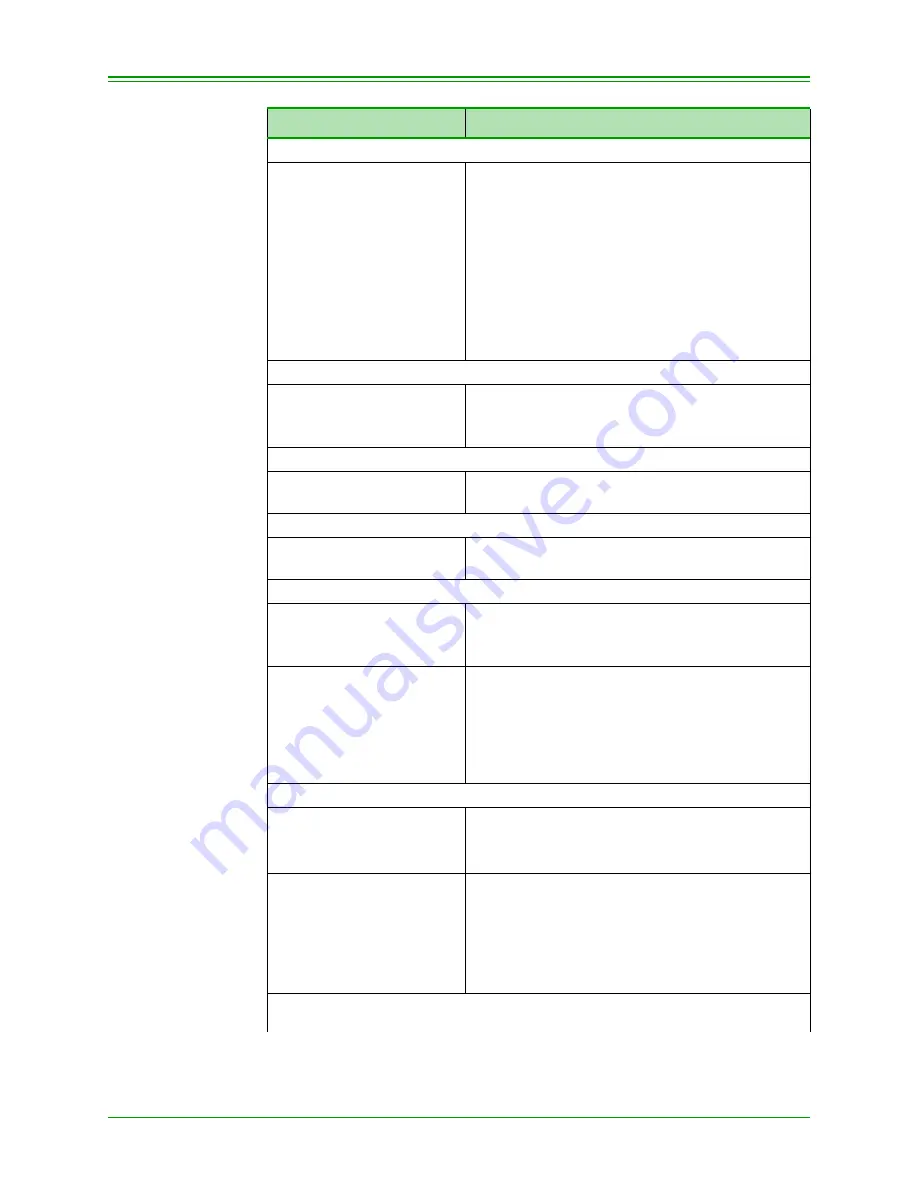

Using the C key, scroll the four various tax options

SALES TAX TYPE

PST YES-A NO–C

HST YES-A NO-C

GST ONLY YES-A NO–C

QST YES-A NO-C

When applicable tax collected is displayed on the

terminal, press A

Select PST if you collect Provincial Sales Tax and

Goods and Services Tax

Select HST if you collect Harmonized Sales Tax

Select GST ONLY if you collect Goods and Ser-

vices Tax only

Select QST if you collect Provincial Sales Tax

and Goods and Service Tax in the province of

Quebec

If PST was selected above

MERCHANT GST NUMBER

MERCHANT PST NUMBER

Key in applicable GST number and press ENTER

Key in applicable PST number and press ENTER

to return to READY SWIPE CUSTOMER CARD

If HST was selected above

MERCHANT GST NUMBER

Key in applicable GST number and press

ENTER.

If GST ONLY was selected above

MERCHANT GST NUMBER

Key in applicable GST number and press ENTER

to return to READY SWIPE CUSTOMER CARD

If QST was selected above

MERCHANT GST NUMBER

MERCHANT QST NUMBER

Key in applicable GST number and press ENTER

Key in applicable QST number and press ENTER

to return to READY SWIPE CUSTOMER CARD

ACCEPT E-COMMERCE

TRANS? YES-A NO-C

To select e-commerce, press A

To reject e-commerce, press C

Note:

Pressing the ENTER key retains the

current setting. Pressing the CANCEL

key at any time will abort the

transaction. The factory default is NO.

If YES was selected above

ENCRYPTED TRANS - A

NON-ENCRYPTED - C

To select encrypted transaction, press A

To select non encrypted transaction, press C

The factory default is NON-ENCRYPTED

ACCEPT MAIL / TEL

ORDERS? YES–A NO-C

To select mail order and telephone transaction,

press A

To reject mail order and telephone transaction,

press C

Note:

Pressing the ENTER key retains the

current setting.

Note:

The card number must be manually keyed in for the e-commerce and

mail / telephone order transactions

TERMINAL DISPLAY

OPERATOR'S ACTIONS