46

QUICK START GUIDE

INCOTEX 500F

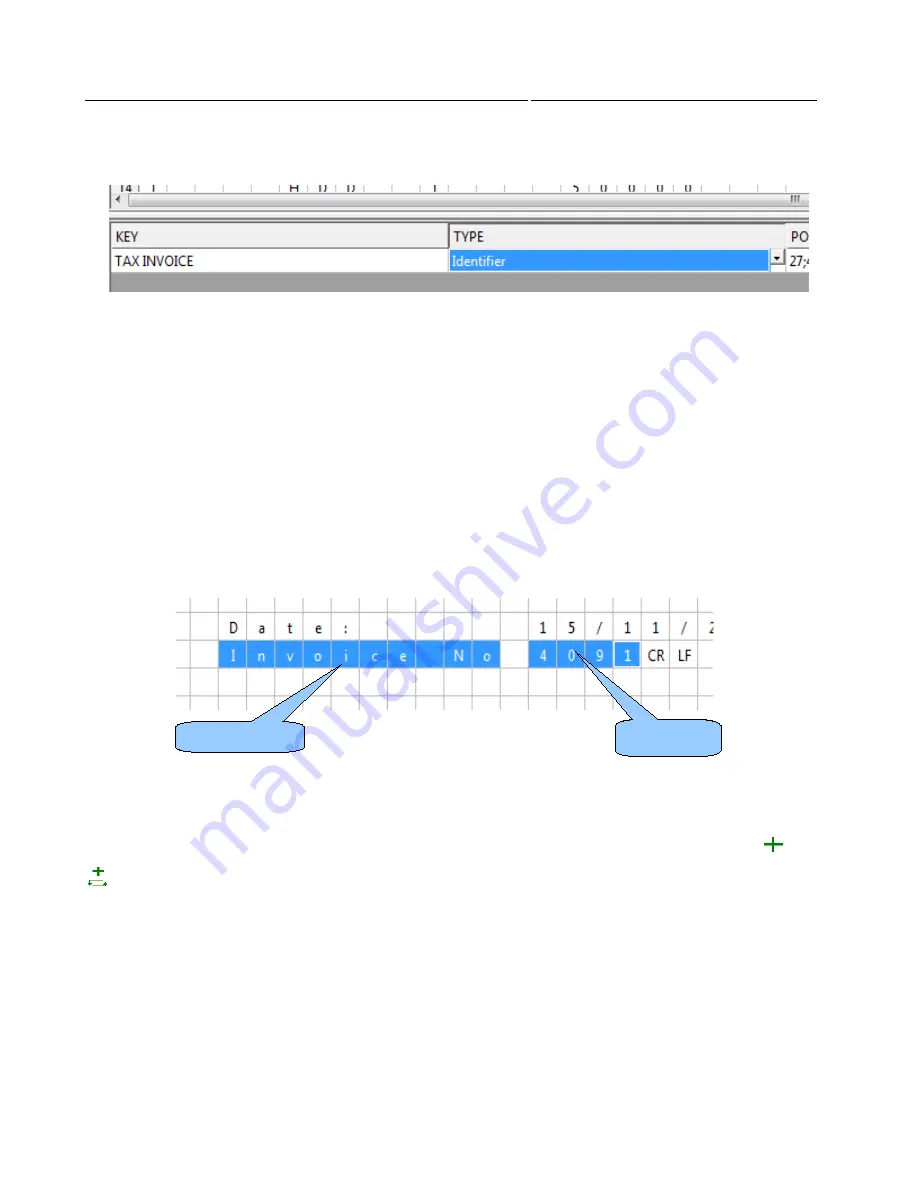

To make this 'key' usable, it should be assigned type.

When selected only words, without a value the type is 'Identifier' as the example.

Amounts are obligatory to be set. There must be clear indication of the total amounts of the goods sold in the

invoice, separated according to the VAT groups they belong to. In the device the VAT groups are set and

automatically read when selling items. The VAT groups are as follows:

VAT group A – > VA = 18%

VAT group B -> V2 = 0%

VAT group 3 -> V3 =exempt

It is very important when setting the fields corresponding to each of the AMOUNTS to set:

AMOUNT VA points the field where the goods value is with VAT rate 18%;

AMOUNT VB points the field where the goods value is with VAT rate 0%;

and AMOUNT V3 points the field where the goods value is with VAT exempt

The program automatically calculates the taxes over each amount.

The program gives opportunity to select whether to set as key fields the NET AMOUNTS, the GROSS

AMOUNTS, or the VAT for the different VAT groups. One must make this choice according to the information

they have in their invoice.

In some cases, due to the format of the text in the invoice some of the lines may appear shifted in the

grid of the program. In these cases the 'TEXT' of the 'KEY' word may go on an upper line than its key.

In such cases select the “KEY” word and the 'TEXT' holding the 'Ctrl' button. Then, instead

, press

to save the selection.

Key

Value

Summary of Contents for 500F

Page 1: ...INCOTEX GROUP ELECTRONIC SIGNATURE DEVICE ESD INCOTEX 500F QUICK START GUIDE 2011 ...

Page 2: ...2 QUICK START GUIDE INCOTEX 500F ...

Page 18: ...18 QUICK START GUIDE INCOTEX 500F In Control Panel find and select Printers and Faxes ...

Page 56: ...56 QUICK START GUIDE INCOTEX 500F This is a view of Archive folder and its content ...