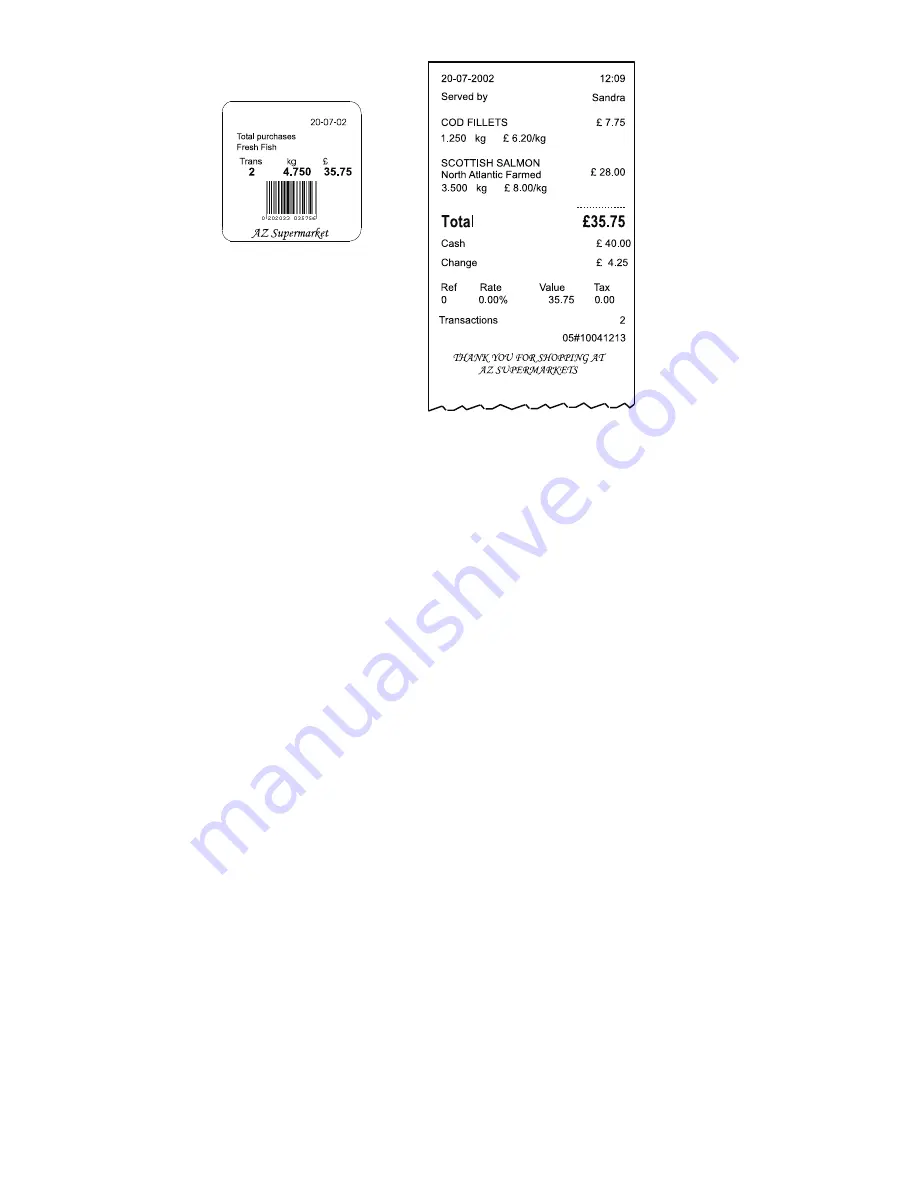

Itemised

Figure 4.3

Typical label and receipt

4.14

About Tax

Tax Rates are usually set for each product PLU (Tax Rate 1 & 2) and you can select which one to use when making a

transaction. For example, depending on whether the customer is eating inside or take-away.

You can change the tax rate used only when the scale is set to Receipt Mode - PoS Enabled.

•

Inclusive tax.

The value of the transaction is displayed including the tax.

•

Exclusive tax.

The value of the transaction is displayed, excluding the tax. The tax is added to the receipt subtotal as a

separate item when the receipt is printed.

Note:

If the country mandates that the tax rate is inclusive (UK Europe etc.), the total does not change when a different tax

rate is selected. For countries where the tax rate is exclusive the total does change.

For products that have more than one tax rate:

1.

For weighed goods, place the goods on the scale and select the PLU.

2.

For non-weighed goods, select the PLU, select the number of items.

3.

Press the Change Tax key, the screen briefly shows the new tax rate. Press the key again to toggle between the two

tax rates.

4.

Continue to assign further transactions.

Net Value Tax

In some countries, it is a requirement that the sales value net of tax is printed on the receipts. For these countries, if an

inclusive tax system is used and tax printing is enabled, the receipt includes:

•

Tax reference

•

Tax rate

•

Net sales

•

Tax value