43

(SP-107) TAX RATE

< SP >--{(107)--[X2/ENTER] or select from the list}--{(Tax #: 1 ~ 4)--[

•

/ENTER] or select from the list}--

[X2 for the next, 00 for another]--(rate: 0 ~ 99.999)--[X2/ENTER to set, CL to cancel]--[CL

]

You can see the settings on X-87 Tax program dump report.

(SP-108) TAX EXEMPTION LIMIT FOR % TAX / TAX TABLE FOR ADD-

ON TAX SYSTEM

Regardless of tax setting by [SF-21], two tax tables are already set to TAX 1 and 2 at the factory by

the auto preset program for samples. In order to use these tax tables in registrations, set the system

function flags [SF-21.c,d,g,h] to 1 by SP-100 for "calculated by add-on tax method and tax table".

When the tax tables are not necessary, ignore them.

TAX EXEMPTION LIMIT AMOUNT FOR % TAX

< SP >--(108)--[X2/ENTER] or select from the list}--{(Tax #: 1 ~ 4)--[

•

/ENTER] or select from the list}--

(tax exemption limit amount: max. 4 digits)--[

•

]--[CL for another]--[CL

]

You can see the settings on X-87 Tax program dump report.

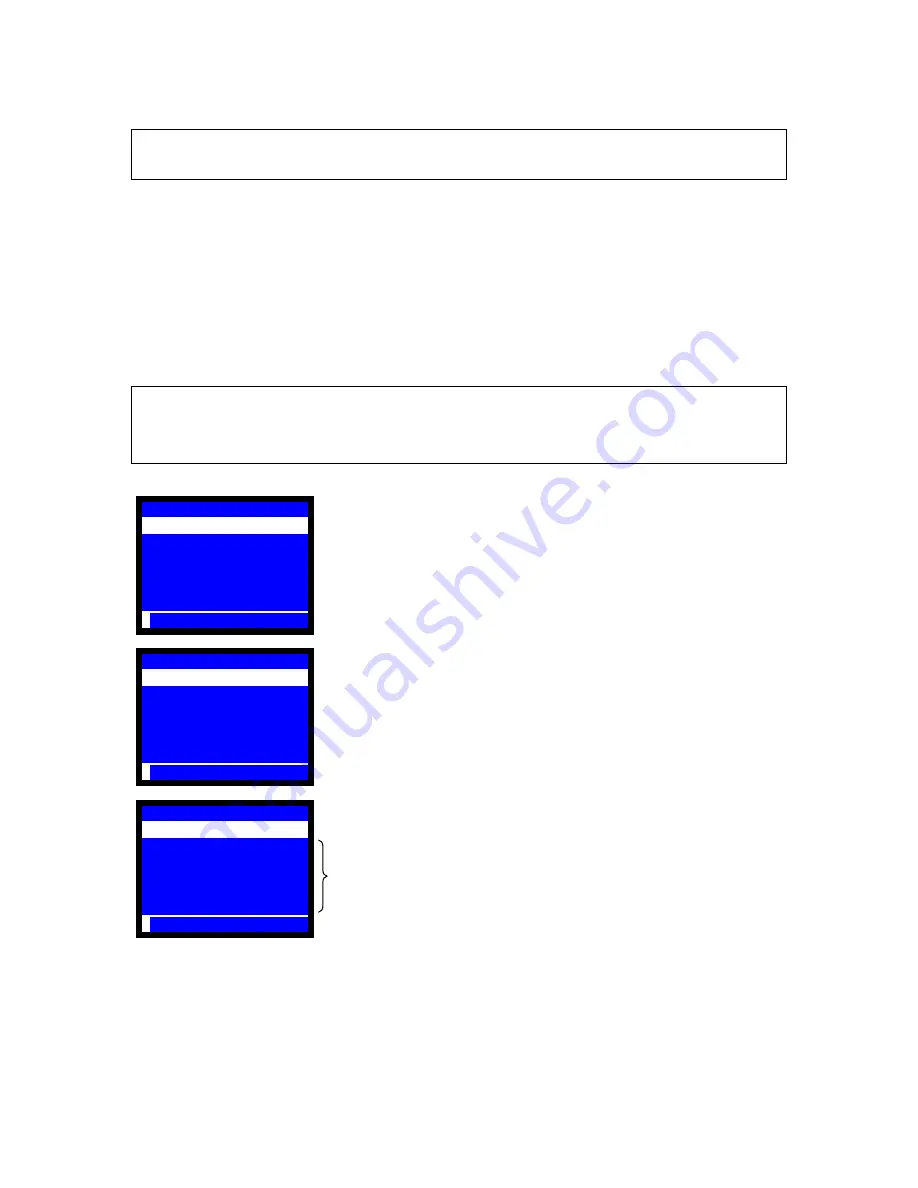

108 TAX TABLE

01-TAX 1

02-TAX 2

03-TAX 3

04-TAX 4

P

108 TAX TABLE

01-EXEM 0.00 0.10

02-I 0.01 0.21

03-I 0.02 0.38

04-I 0.03 0.56

05-I 0.04 0.73

06-I 0.05 0.91

P

EXEMPT< 50>

108 TAX TABLE

01-EXEM 0.00 0.50

02-I 0.01 0.61

03-I 0.02 0.78

04-I 0.03 0.96

05-I 0.04 1.13

06-I 0.05 1.31

P

1st TAX< >

1.

In the SP position, enter program number and press X2 or ENTER key or

select this program from the list.

2.

Enter tax number and press [

•

] or ENTER or select from the list.

3.

Enter tax exemption limit amount (max. 4 digits) and press [

•

]. (ENTER key

can not be used.)

4.

"1st TAX < >" is displayed. Press CL.

5.

Continue the program for another tax or press CL key to finish the sequence.

Ignore these settings if not necessary.