57

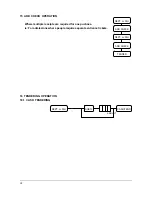

11.2 EXCLUSIVE VAT SYSTEM

( 1 )

Exclusive VAT

is used when

a tax amount

is

not included in the item price

,

and a tax amount is calculated by a tax rate.

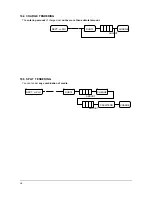

( 2 )

TAX EXEMPT

While the

exclusive VAT

system is in use, you can

exempt a taxable department or PLU from

tax

.

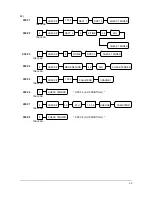

* Inclusive VAT *

* Exclusive VAT *

DEPT. or PLU

TAX

Содержание ER-5100

Страница 23: ...22 ...

Страница 28: ...27 Validation on CASH TEND tendering is compulsory c YES 4 NO 0 ...

Страница 30: ...29 NO 0 68 Disable printing FOREIGN AMOUNT during Conversion operation a YES 1 NO 0 a ...

Страница 33: ...32 2 8 3 DESCRIPTOR PROGRAMMING SCAN PAID OUT CASH TEND ...

Страница 47: ...46 2 19 PARAMETERS PROGRAM SCAN SUBTL CASH TEND ...