73

Bond calculations

In its bond calculations

, this calculator conf

or

ms to r

ules set up b

y

the book titled

Standard Secur

ities Calculation Methods

, b

y

J

an

Ma

yle

, Secur

ities Industr

y Association, 1993.

Bond calculation is based on the f

ollo

wing r

ules:

1.

Whene

v

er the redemption date happens to be the last da

y of a

month, coupons are also paid on the last da

ys of months

. F

or

e

xample

, if coupon pa

yments are semi-ann

ual and the redemp-

tion date is September 30, coupon pa

yments occur on March 31

and September 30.

2.

If coupons are to be paid twice a y

ear and the redemption date

is set to A

ugust 29, 30, or 31, coupon pa

yments f

or F

ebr

uar

y

occur on the 28th (29th f

or leap y

ears).

3.

The

“Odd Coupon”

is not suppor

ted.

4.

All data stored or calculated f

or bonds are assumed to be posi-

tiv

e v

alues

. Negativ

e v

alues in an

y of the v

a

riab

les used b

y

bond

calculations will cause errors

.

The f

o

rm

ulas used f

or bond calculations are sho

wn using the f

ollo

w-

ing v

a

riab

le defi

nitions:

TD:

T

otal n

umber of da

ys in the coupon per

iod that begins with the

coupon date pre

vious to the settlement date and ends with the

fi rst coupon date after the settlement date

. (On the 360-da

y

calendar

,

TD is 180 f

or semi-ann

ual coupon and 360 f

or ann

ual

coupon.)

PD:

The n

umber of da

ys preceding the settlement date in the cou-

pon per

iod descr

ibed abo

v

e

. (see

“Da

y and date calculations”)

FD:

The n

umber of da

ys f

ollo

wing the settlement date in the coupon

per

iod descr

ibed abo

v

e

(in

TD).

FD =

TD – PD

NP:

The n

umber of whole coupon per

iods betw

een the settlement

date and the redemption date (rounded up to the ne

xt highest

whole n

umber

, if necessar

y).

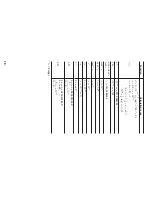

For one coupon period or less until r

edemption of bond:

For mor

e than one coupon period until r

edemption:

wher

e CPN = COUPON(PMT), RDV

= REDEMPT(FV), N = CPN/Y(N), YIELD = YIELD(I/Y),

PRICE = PRICE(PV).

Y

ield is obtained as YIELD, which satis

es the above equations.

Err

or

CPN < 0 or RDV

< 0 or PRICE < 0 or M-D-Y 1 M-D-Y 2 or YIELD –100

Appendix.indd 73

06.7.10 8:41:58 PM