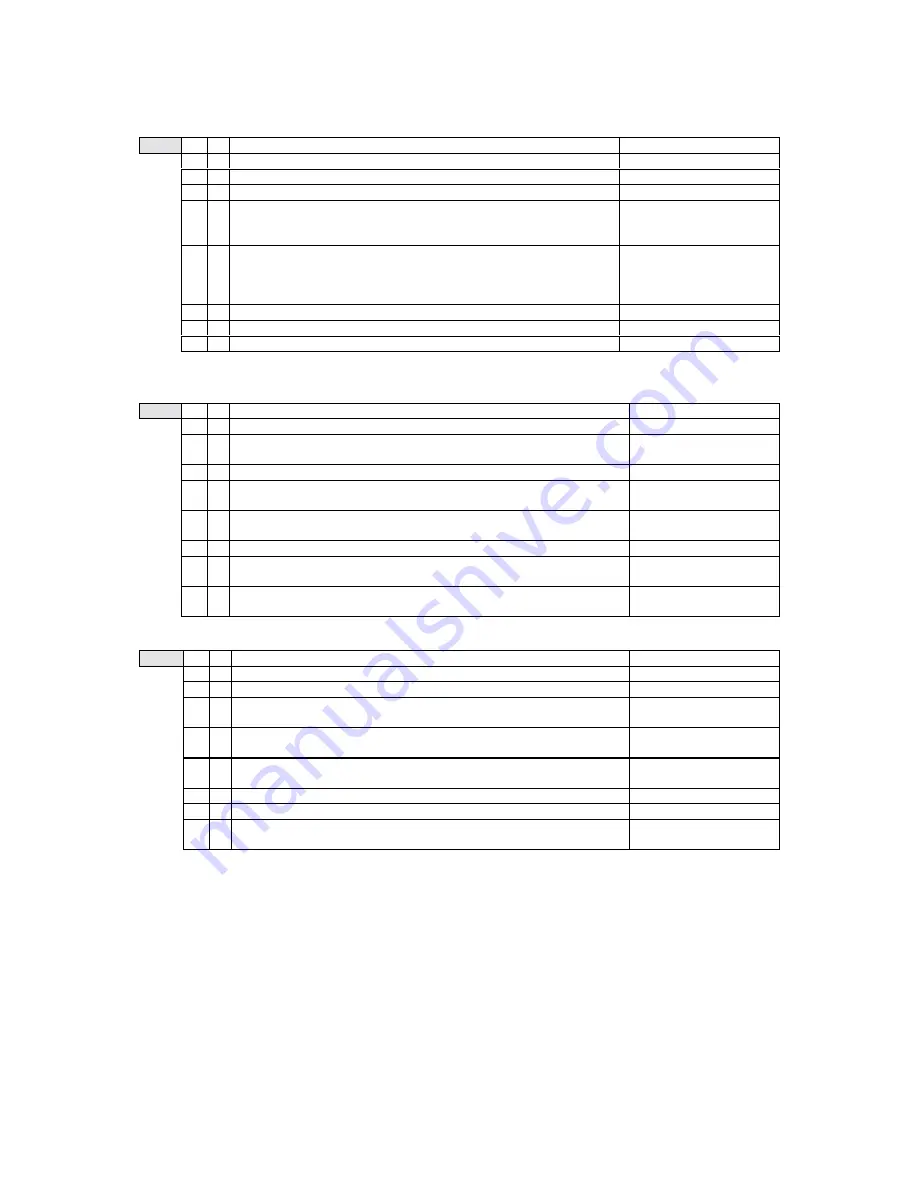

73

REPORT (5)

SF-30 1/0 bit

1

0

a

b

c

d VAT amount is re-calculated from the taxable subtotal at report taking.

VAT amounts calculated at

registration are accumulated

and printed on reports.

e VAT amounts re-calculated from the taxable amount on each slave are

consolidated on the master. [d=1]

VAT amount is re-calculated

from the taxable amount

consolidated by the master.

[d=1]

f

g

h Simple PLU program dump report

Normal report

Bit d

VAT TAX and NET SALES on the clerk reports are not printed under [d=1].

SECURITY (1)

SF-31 1/0 bit

1

0

a Cash declaration prohibited

permitted

b Cash declaration compulsory before 1st level reports (except for report

numbers : 12, 19, 43, 60, 62, 64, 70,78, 79)

[a=0]

not compulsory

[a=0]

c Void permitted regardless the subtotal becomes minus

prohibited

d Cash declaration compulsory before 1st level reports (report numbers : 1, 3,

8) including CID

[b=1]

before 1st level reports

(same as b=1)

e Drawer close not compulsory (drawer sensor is disregarded regardless if it is

fitted)

compulsory if an optional

drawer sensor is fitted

f

g All functions in SP position done by a clerk who is permitted by

[CF-1.h=1]

Do not set before [CF-1.h] is set to 1.

(page 53)

by everybody

h Programming in Z1/P & Z2 position done by a clerk who is permitted by

[CF-1.g=1]

Do not set before [CF-1.g] is set to 1.

(page 53)

by everybody

SECURITY (2)

SF-32 1/0 bit

1

0

a

b

c

Refund

operation requires to turn the control key to Z1/P position

[CF-1.b=0]

to R position

d

Void/Transaction void

operations require to turn the control key

to Z1/P position

[CF-1.b=0]

to R position

e

Discount

operation requires to turn the control key to Z1/P position

[CF-1.b=0]

to R position

f

-%

operation requires to turn the control key to Z1/P position

[CF-1.b=0]

to R position

g

No sale

operation requires to turn the control key to X position

[CF-1.a=0]

to R position

h

Manual price entry

requires to turn the control key to X position

[CF-1.a=0]

to R position

Refer to clerk security function [CF-1].

(page 53)