BankSA EftpoS 1i terminal User Guide

8

BankSA EftpoS 1i terminal User Guide

9

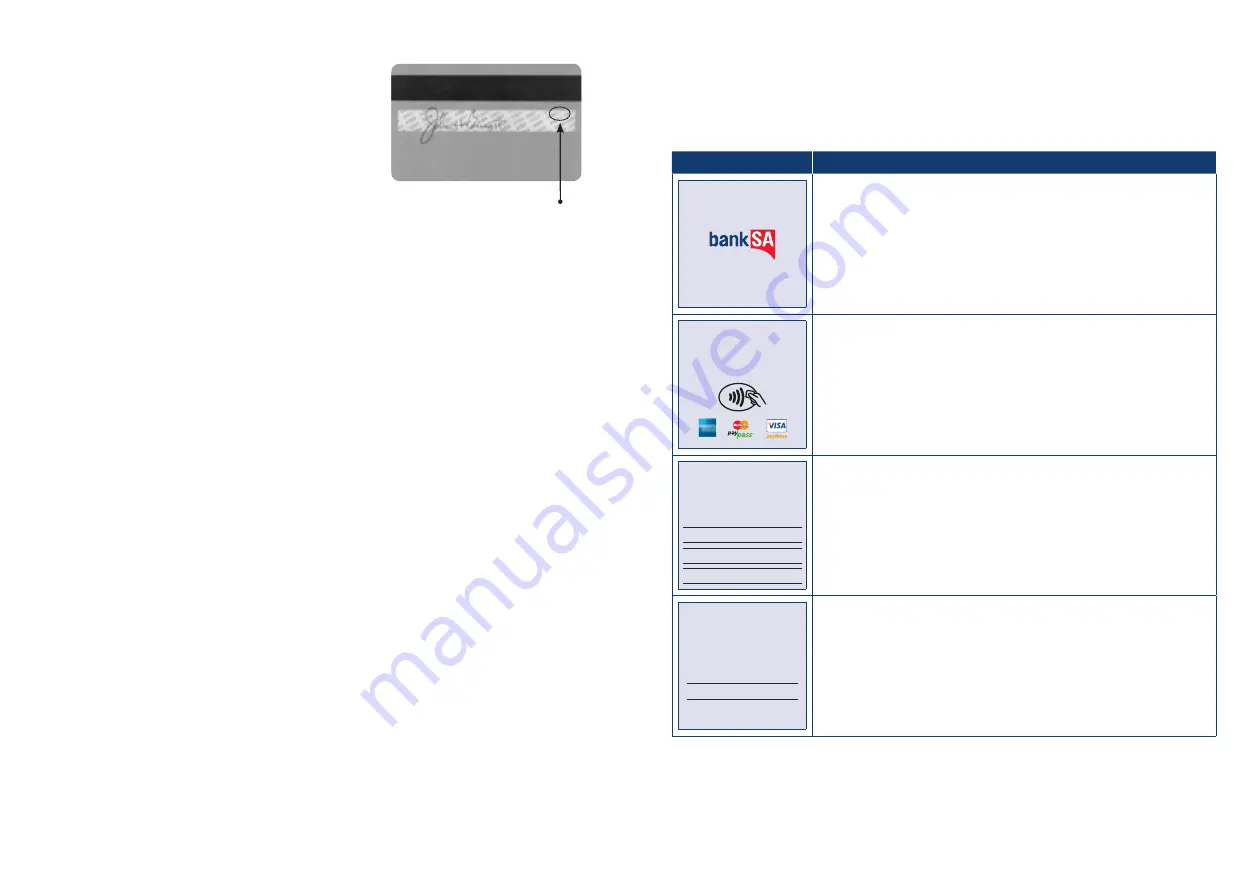

3.4 CCV Security Codes

What is CCV?

The CCV is a three or four digit value printed on a payment

card (usually on the signature panel), used to verify card-not-

present transactions.

CCV security codes are a way to lessen the risk of fraud and

chargeback when the cardholder is not physically present, or

when a card cannot be inserted/swiped successfully. In these

cases you can key in the card number.

A CCV security code is printed on the card but does not appear on receipts. When you key in the CCV

code, a check is made that the code matches the card number. This gives greater assurance that the

customer is in possession of the card.

Note:

• Some cards do not have a CCV code.

• CCV (Card Check Value) is also known as CVV and CVC.

Where can I find the CCV Security Code?

Some cards, for example MasterCard and Visa, have a three-digit CCV printed on the signature panel

on the reverse side of the card. Other numbers may precede the CCV. The last three digits on the

signature panel are the CCV.

Other cards, for example American Express, have a four-digit CCV on the front of the card, above the

account number.

Some cards do not have a CCV.

Should I save CCV Security Codes?

No. It is prohibited to store the CCV codes. They must remain secret. You must not write them down or

save them electronically. Doing so might lead to heavy penalties.

4.0 Everyday Functions

4.1 Purchase/Sale

How to process a Purchase transaction

Terminal Screen

Next Step

READY

14:35 29/10/13

Start by initiating the transaction via the POS interface.

▮

▯

▯

▯

PURCHASE $X.XX

PRESENT CARD

Is it safe?

How does it work?

Using your Westpac MasterCard or Visa contactless card is simple.

Just follow these four easy steps.

Contactless technology offers a fast method of payment for your

purchases and is as secure as using your current card in the usual

ways. Here are some of the ways it offers the same protection:

•

Trusted providers – All contactless transactions are processed

through the reliable and secure Westpac and MasterCard or Westpac

and Visa networks.

•

No accidents – To make a purchase, your card needs to be within 4cm

of the contactless terminal for more than half a second, the merchant

must have already entered the transaction amount into the terminal

and it must be approved. So, you will not be billed twice, even if you

accidentally hold your card against the terminal more than once.

•

Fraud protection – The 24/7 Falcon™ fraud detection system gives

you greater protection from card fraud by monitoring any unusual

purchase activity.

•

Peace of mind – The MasterCard and Visa Zero Liability policies

protect you against any unauthorised purchase transactions, provided

you have complied with the terms of the policy. Visit

westpac.com.au

for details.

The added security of CHIP technology

Your Westpac MasterCard or Visa Card also features an embedded chip

that will give you access to the latest in card security.

CHIP technology is currently an effective counter-measure against

counterfeit and skimming fraud. The chip stores information more

securely than the magnetic strip, which makes it harder for fraudsters

to copy your card details.

1.

Check that your card has the

MasterCard PayPass or Visa

payWave logo.

2.

At participating merchants where

you see your card’s logo and

the contactless symbol, let the

merchant know you’d like to pay

using your contactless card and

whether you’d like a receipt for the

transaction.

3.

When the transaction amount

is shown on the terminal,

hold your card against the

contactless symbol.

4.

The terminal will indicate once your

transaction is approved. Collect

your receipt if you asked for one,

and you’re done.

®

Bring the card into contact with the terminal by swiping, inserting or

tapping it.

PURCHASE

$X.XX

MASTERCARD

SELECT ACCOUNT

CHEQUE OR PRESS 1

SAVINGS OR PRESS 2

CREDIT OR PRESS 3

For magnetic stripe and chip cards, have the customer select an account

on the touch screen or keypad.

Note:

The terminal will only display the available accounts for the card

entered

PURCHASE $X.XX

MASTERCARD CR

Key PIN and ENTER

XXXX

Ask the customer to enter their PIN on the terminal and press ENTER, or

just press ENTER to sign (if allowed*).

4000 0012 3456 7890 123

AUTHORISED SIGNATURE

NOT VALID UNLESS SIGNED

CCV