60 — M

ORTGAGE

Q

UALIFIER

P

LUS

®

P

X2

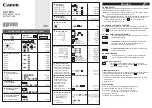

Solving for Actual Qualifying Ratios

A buyer who makes $120,000 annually and has $550 in long-term

monthly debt wants to borrow $275,000 to purchase a home. He has

$68,750 for the down payment and the property tax/insurance rates

are estimated at 1.4% and 0.2%, respectively; monthly homeowner’s

association dues at $65. Use 6.5% interest for 30 years. What are

his actual ratios? What is the price of the home he can afford? What

is the monthly payment?

STEPS

KEYSTROKES

DISPLAY

Clear calculator

o o

0.00

Enter interest

6 • 5 ˆ

6.50

Enter term

3 0 T

30.00

Enter loan amount

2 7 5 ) l

275,000.00

Enter down payment

6 8 7 5 0 d

68,750.00

Enter annual income

1 2 0 ) i

120,000.00

Enter monthly debt

5 5 0 D

550.00

Enter property tax rate

1 • 4 s 7

1.40

Enter property ins. rate

• 2 s 8

0.20

Clear mtg. ins. rate*

0 s 9

0.00

Enter monthly assn. dues**

6 5 s D

65.00

Display stored ratios

q

28.00-36.00

Calculate actual ratios

q

“run” 22.62-28.12

Find sales price

P

343,750.00

Find the P&I payment

p

1,738.19

Find the PITI payment

p

2,196.52

Find the total payment

p

2,261.52

*Should be set to zero in this case, as the down payment is 20%; to check down pay-

ment percentage, press

d

again and it will read 20.00%.

For Desktop Model (#43442) Users:

**Enter

6 5 A

on the Desktop model.