68 — Q

UALIFIER

P

LUS

®

III

FX

Combo Loan (80:10:10) vs. Fixed-Rate Loan with Mortgage

Insurance

You’d like to show your client the savings of a fixed-rate Combo

Loan (80:10:10) over that of a standard, fixed-rate loan with mort-

gage insurance. You have the following parameters:

FIXED-RATE

FIXED-RATE

COMBO LOAN

LOAN w/MI

(1st TD – 2nd TD)

Loan Amount

100,000 100,000

Interest

7%

7% – 9%

Term

30

30 year – 30 year

MI

.5% --

LTV

90%

80% – 10%

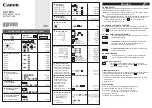

STEPS

KEYSTROKES

DISPLAY

1. Enter Fixed-Rate Loan Values and Find Total Payment:

Clear calculator

o o

0.00

Enter Loan Amount

1 0 0 ) l

100,000.00

Enter Down Payment

1 0 d

10.00

Enter annual Interest rate

7 ˆ

7.00

Enter Term in years

3 0 T

30.00

Enter MI (mortgage

insurance) rate

• 5 s 9

0.50

Clear property tax rate

0 s 7

0.00

Clear property insurance

rate

0 s 8

0.00

Solve for monthly P&I

Payment

p

“run” 665.30

Solve for monthly PITI Payment

(with MI)

p

706.97

2. Enter Combo Loan Values:

Enter 1st TD

Interest:Term

7 : 3 0 !

7.00-30.00

Enter 2nd TD

Interest:Term

9 : 3 0 s !

9.00-30.00

(Cont’d)