SAM4s ER-265 Operator's and Programming Manual v1.14

Quick Setup

23

Programming Tax

Most sales taxes can be programmed by entering a tax percentage rate. However, in some cases

you may find that tax that is entered as a percentage does not follow exactly the tax chart that apply

in your area. If this is the case, you must enter your tax using tax table programming. This

method will match tax collection exactly to the break points of your tax table. See “Tax Table

Programming” on page 67.

Important Note: After you have entered your tax program, test for accuracy by entering

several transactions of different dollar amounts. Carefully check to make sure the tax

charged by the cash register matches the tax amounts on the printed tax chart for your area.

As a merchant, you are responsible for accurate tax collection. If the cash register is not

calculating tax accurately, or if you cannot program your tax properly from the information in

this manual, contact your local SAM4s dealer for assistance.

Programming a Tax Rate Percentage

1.

Turn the control lock to the

PGM

position.

2.

Enter the rate, with a decimal. 0.000-99.999. It is not necessary to enter proceeding

zeros. For example, for 6%, enter 06.000 or 6.000.)

3.

Enter

00

.

4.

Enter:

1

to set tax rate 1

2

to set tax rate 2

3

to set tax rate 3

5.

Press the

TAX

key.

6.

Press the

CASH/TEND

key to end programming.

7.

See tax rate program examples on page 14.

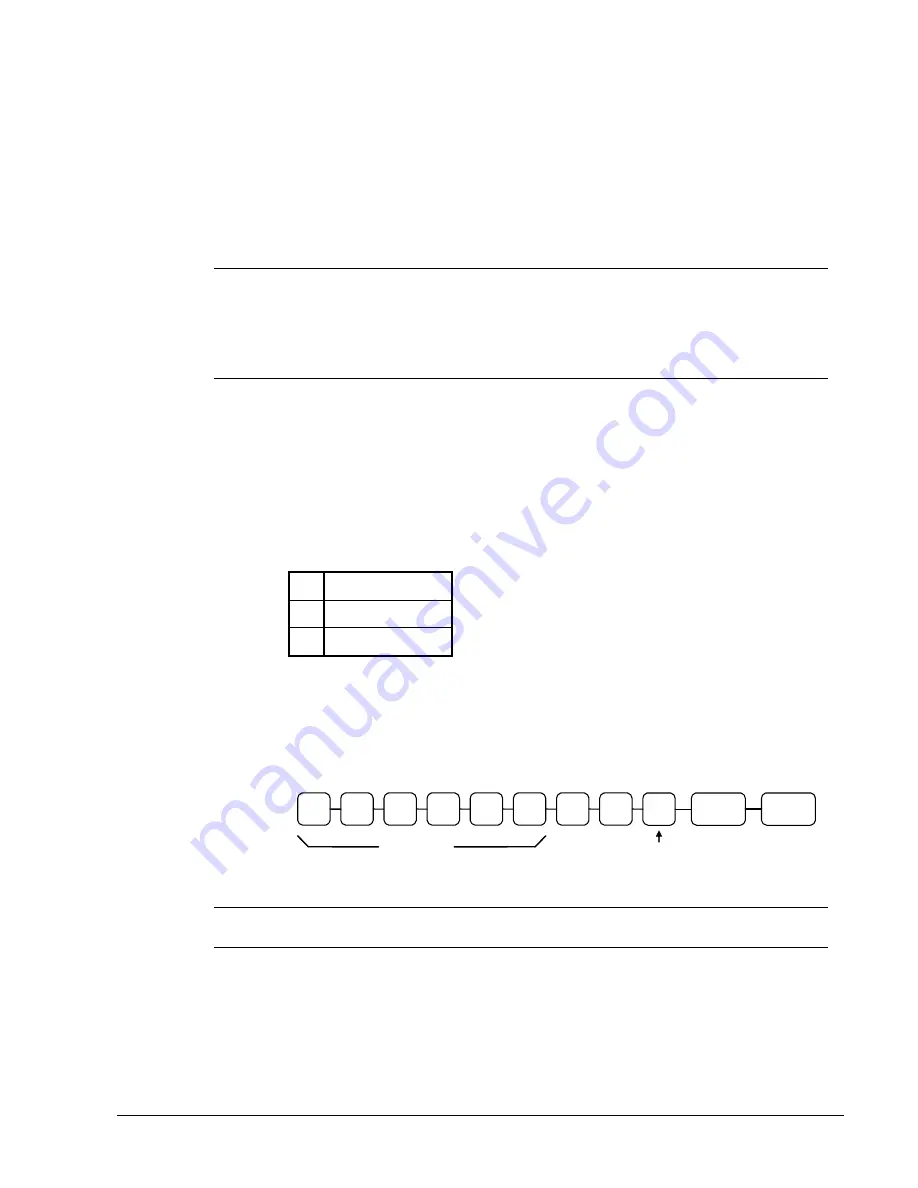

Tax Rate Programming Flowchart

.

TAX

0

0

Tax Rate

Tax #

(1-3)

CASH/

TEND

Please Note: After programming the tax rate, you must program your department or

departments taxable to calculate tax. See page 15 for department programming steps.