Cash Register CM 980-SF / 980-F / 960-SF / 962-SF

Olympia 2012

Page 99

All Rights Reserved!

6.25

Programming the tax rate

A maximum of 8 tax rates can be programmed.

Note:

Three tax rates are preprogrammed in the cash register:

Tax rates 1 and 3 are preprogrammed at the factory to 19%.

Tax rate 2 is preprogrammed at the factory to 7%.

Tax rates 4 to 8 are preprogrammed at the factory to 0%.

All the tax rates are preprogrammed in such a way that they are included in the totals.

Note:

If the cash register is reset, these tax rates are reactivated.

Tip:

If you operate with these tax rates, you need not carry out any further adjustments.

Tax rate 8 is a special tax rate. Tax rate 8 is used for departments or PLUs to which no tax is added to the sale (neutral

sales). The sum of all the sales with tax rate 8 is printed separately in the reports but not added to the sale.

Note:

Leave one tax rate without a tax rate assigned. This serves for neutral sales, e.g for cigarettes when a clerk

purchases a pack from a machine as a service for a guest.

Tax rate 7 is also a special tax rate because, in the case of a discount on the subtotal, the items assigned tax rate 7 are

not included!

Example:

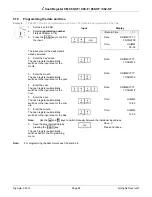

19.6% should be programmed for tax rate 3.

Input Display

==TAX GROUP

00-0 1 1

1. Set the key to PRG.

2. Select

programming number

30

(see Chapter 6.1.2).

3. Press

the

┣

CASH

┫

key to con-

firm the input.

19.00

RATE%

==TAX GROUP

00-0 3 2

4. Change the tax rate memory

location: Press the

┣

CASH

┫

key

until the required memory loca-

tion is displayed in the logo

message line.

2x

00.00

RATE%

5. Use

the

┣↑┫

and

┣↓┫

keys to

move to the

RATE%

input

area.

0.00

RATE%

6. Use the digit keys to enter the

tax rate (with decimal point and

decimal places).

19.60

RATE%

7. Press

the

┣

CASH

┫

key to con-

firm the input.

Save...!!

Please Continue...

8. Conclude programming by

pressing the

┣

SUB-TOTAL

┫

key.

Important note: Assigning tax rates to the PLUs

The tax rate is assigned to the PLUs/departments when programming the departments. The tax totals can only be

calculated and printed on the receipt when the tax rate is actually assigned to the departments.