ECR User`s Manual

ECR User`s Manual

1

===

NTS

===

P Settings

R Registration

X PLUS&Departments

Z Reports

2

===

NTS

===

M Member

R Restaurant

T TAX/VAT

3

=======

TAX/VAT

=======

4

TAX/VAT Settings

TAX/VAT Report

Select TAX

VAT

Default Ra 0%

Printing: X

Save...

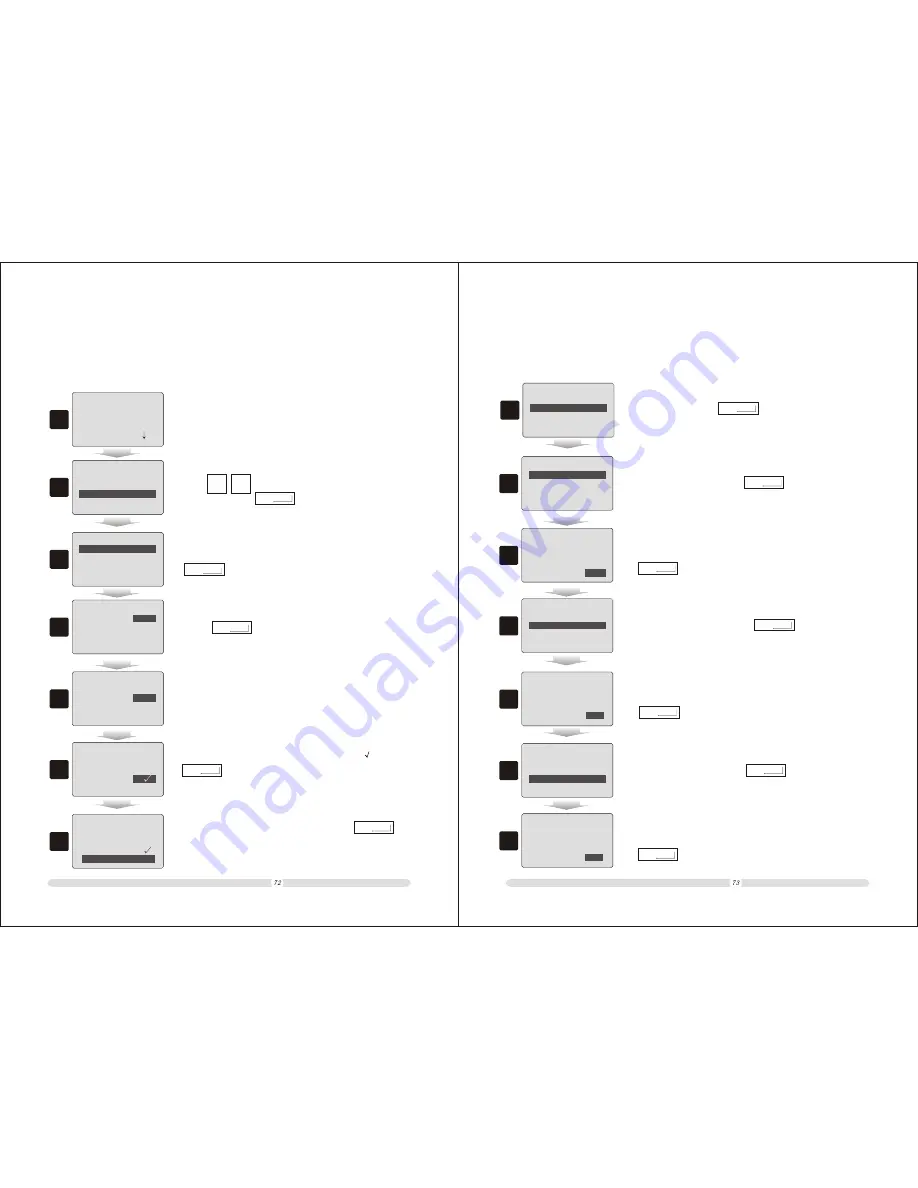

8.1 Set TAX/VAT/NONE

1.

Go to the main menu page;

2. Press to direct the cursor block to “ TAX/VAT”

option, then press ;

Cash

Enter

3. Select “ TAX/VAT Settings” option in TAX/VAT page, then press

;

Cash

Enter

4. Direct the cursor block to “ Select TAX:VAT ” ,then

press to shift tax selection ways among

NONE/TAX/VAT /GST;

This register machine supports several tax ways: None, TAX, VAT and GST. It has powerful fiscal

report function. Users can check reports by daily, monthly or yearly statistics.

Chapter 8

TAX/VAT setting and report

RA/PGUP

RO/PGDN

Cash

Enter

5

5. Direct the cursor block to “ Select TAX/VAT:17% ” ,key in a

number to set the tax rate;

6

6. Direct the cursor block to “ Select TAX/VAT:

” ,press

to select whether print tax or not in the receipt;

Cash

Enter

===

TAX/VAT Settings

===

Select TAX VAT

Default Ra

Printing: X

Save...

17%

===

TAX/VAT Settings

===

===

TAX/VAT Settings

===

Select TAX VAT

Default Ra 17%

Printing:

Save...

7

7. Direct the cursor block to “ Save... ” ,press

to save the setting .

Cash

Enter

===

TAX/VAT Settings

===

Select TAX VAT

Default Ra 17%

Printing:

Save...

8.2 Tax report

The fiscal register module has powerful report functions. Users can check report at any

time period. Follow below steps to print out the report as users need.

1

=======

TAX/VAT

=======

TAX/VAT Settings

TAX/VAT Report

1. In “TAX/VAT ” page , direct the cursor block to “ TAX/VAT

Report ”,then press and enter into report selection

page;

Cash

Enter

2

D Daily Report

M Monthly Report

Y Yearly Report

3

4

===

TAX/VAT Report

===

DD/MM/YYYY

From

08- 05- 2009

To

09- 05-

2009

D Daily Report

Y Yearly Report

M Monthly Report

===

TAX/VAT Report

===

2. In report selection page,direct the cursor block to

“D Daily Report ”, press and enter into date

period selection page ;

Cash

Enter

3. Direct the cursor block to a date option,key in a number to

set the corresponding date , after all set properly , press

to print out the Daily Report;

Cash

Enter

4. In report selection page, direct the cursor block to

“M Monthly Report ”, press and enter into month

period selection page ;

Cash

Enter

5. Direct the cursor block to a year/month option,key in a number

to set the corresponding month , after all set properly , press

to print out the Monthly Report;

Cash

Enter

6. In report selection page, direct the cursor block to

“Y Yearly Report ”, press and enter into year

period selection page;

Cash

Enter

5

MM/YYYY

From

04

To

- 2009

05 -

2009

6

D Daily Report

M Monthly Report

Y Yearly Report

===

TAX/VAT Report

===

7. Direct the cursor block to a year option, key in a number

to set the corresponding year , after all set properly , press

to print out the yearly Report.

Cash

Enter

7

YYYY

From

To

2008

2009