38

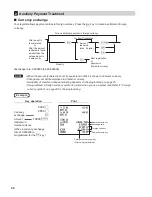

Manual tax 1 through 4 system (Manual entry method using programmed percentages)

s

t

This system provides the tax calculation for taxable 1, taxable 2, taxable 3, and taxable 4 subtotals. This

calculation is performed using the corresponding programmed percentages when the

t

key is pressed just

after the

s

key. After this calculation, you must finalize the transaction.

Automatic VAT 1 and tax 2 through 4

This system enables the calculation in the combination with automatic VAT 1 and tax 2 through 4. This

combination can be any of VAT 1 and tax 2 through 4. The tax amount is calculated automatically with the

percentages previously programmed for these taxes.

NOTE

•

The tax status of PLU/subdepartment depends on the tax status of the department which the PLU/

subdepartment belongs to.

•

VAT/tax assignment symbol can be printed at the fixed right position near the amount on the receipt as

follows:

VAT1/tax1

A

VAT2/tax2

B

VAT3/tax3

C

VAT4/tax4

D

When the multiple VAT/tax is assigned to a department or a PLU, a symbol of the lowest number

assigned to VAT/tax rate will be printed. For programming, please refer to “Various Function Selection

Programming 1” (Job code 66) on page 56.

Example

Key operation

$

s

t

A

(When the manual

VAT 1 through 4

system is selected)

Содержание XE-A137

Страница 1: ...ELECTRONIC CASH REGISTER FULL DETAILED INSTRUCTION MANUAL XE A137 XE A147 MODEL XE A137 XE A147 ...

Страница 46: ...44 Alphanumeric character code table DC Double size character code ...

Страница 86: ...SHARP ELECTRONICS Europe GmbH Postbox 105504 20038 Hamburg Germany XE A137 XE A147 ...