14

5

Tax Programming

If you program the VAT/tax, the cash register can calculate the sales tax. In the VAT system, the tax is included

in the price you enter in the register, and the tax amount is calculated when tendered according to the VAT rate

programmed. In the tax system, the tax is calculated when tendered according to the tax rate programmed, and

added to the price. The cash register can provide totally 6 kinds of VAT/tax systems (automatic VAT1-4,

automatic tax 1-4, manual VAT 1-4, manual VAT 1, manual tax 1-4, and automatic VAT1 and automatic tax 2-4

systems) and 4 kinds of rates. By default, the cash register is pre-programmed as automatic VAT1-4 system.

When you program tax rate(s) and taxable status for each department (by default, VAT1/tax1 is set to taxable.),

tax will be automatically added to sales of items assigned to the department according to the programmed tax

status for the department and the corresponding tax rate(s).

For details of the tax systems, refer to “Computation of VAT (Value Added Tax)/tax” section. To change the tax

system, please refer to “Other programming” of “Various Function Selection Programming 1” section (Job code

69).

■

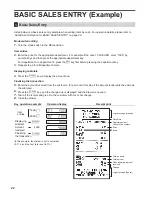

Tax rate programming

The percent rate specified here is used for tax calculation on taxable subtotals.

To program other kind of tax

To program “0.0000”

To delete a tax rate

*Tax rate: YYYYYYY

Tax rate=0.0000 to 100.0000

A

s

s

@

@

v

Tax number

(1 to 4)

9

*Tax rate

Key operation example

s

9

@

2

@

0070000

s

A

Содержание XE-A137

Страница 1: ...ELECTRONIC CASH REGISTER FULL DETAILED INSTRUCTION MANUAL XE A137 XE A147 MODEL XE A137 XE A147 ...

Страница 46: ...44 Alphanumeric character code table DC Double size character code ...

Страница 86: ...SHARP ELECTRONICS Europe GmbH Postbox 105504 20038 Hamburg Germany XE A137 XE A147 ...