80

■

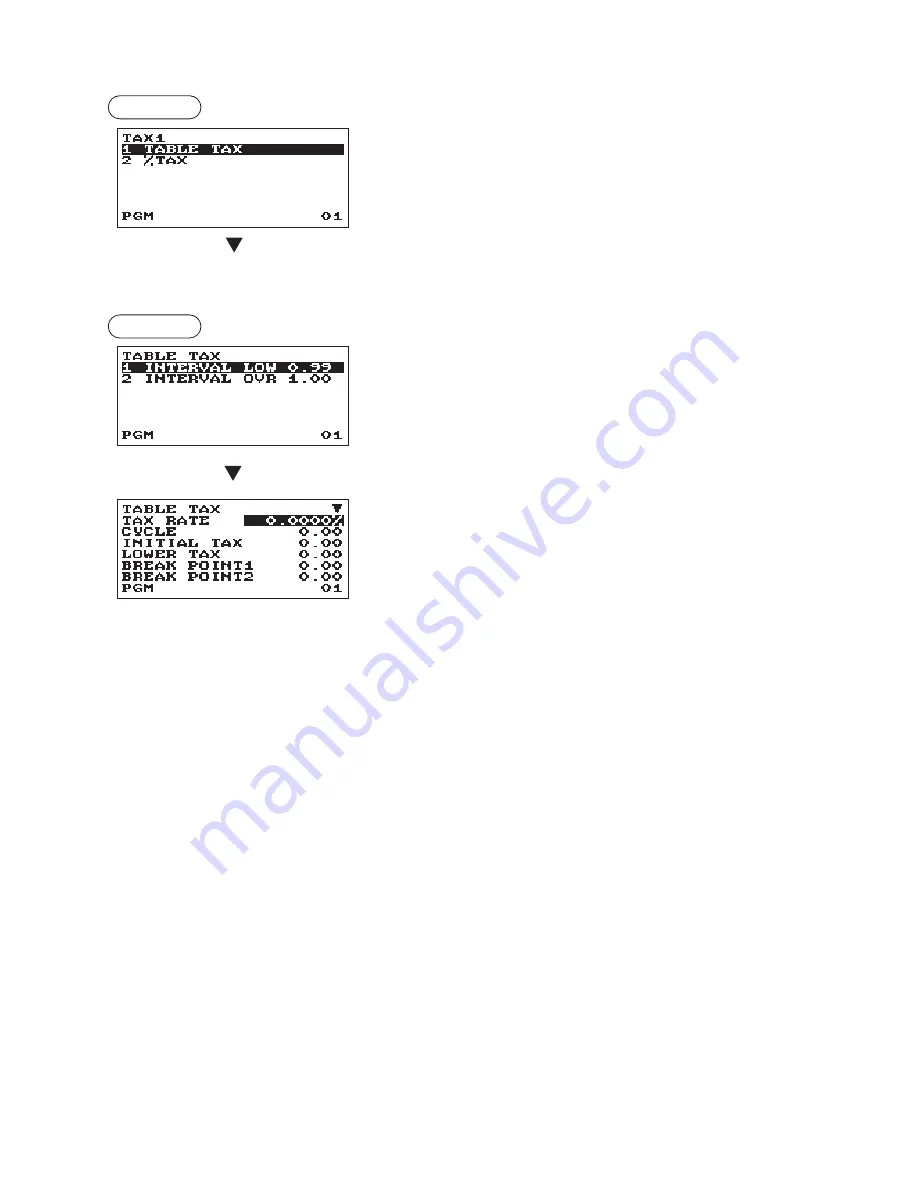

Tax 1 through 4

Procedure

Selection of tax method

(To the following table tax or % tax)

TABLE TAX:

Programmed tax table is used.

% TAX:

Programmed % tax rate is used.

• Table tax

Procedure

Selection of the interval

The screen continues.

• INTERVAL (Use the selective entry)

LOW 0.99: Less than 0.99 (max. 72 break points)

OVR 1.00: More than 1.00 (max. 36 break points)

Program each item as follows:

• TAX RATE (Use the numeric entry)

Tax rate (max. 7 digits: 0.0000 to 999.9999%).

• CYCLE (Use the numeric entry)

Tax table cycle (max. 4 digits: 0.01 to 99.99).

• INITIAL TAX (Use the numeric entry)

Initial tax (max. 3 digits: 0.01 to 9.99).

• LOWER TAX (Use the numeric entry)

Lowest taxable amount (max. 5 digits: 0.00 to 999.99).

• BREAK POINT1 through 72 (Use the numeric entry)

Break point amount (max. 5 digits: 0.01 to 999.99).

The programming data of tax table are as follows.