Business Computations

powerOne™ Personal

23

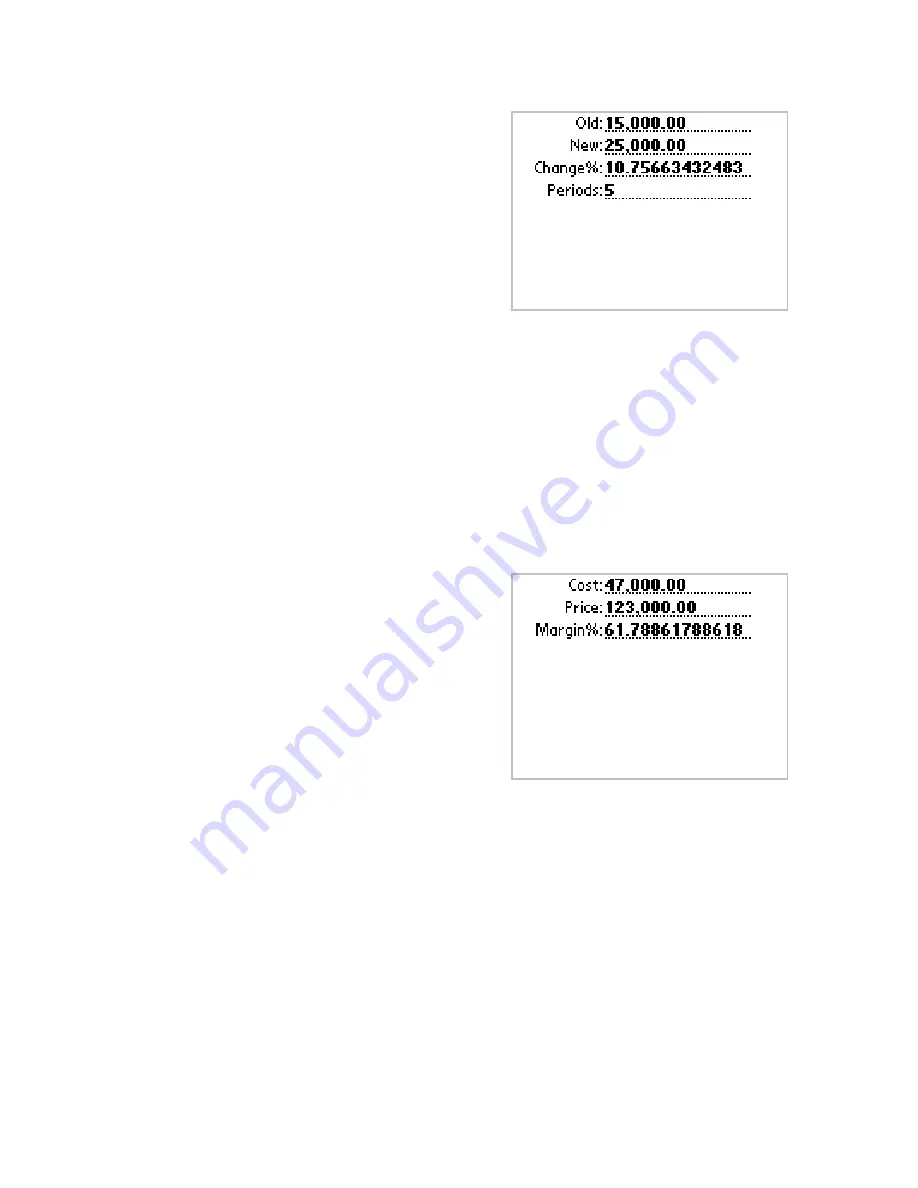

•

Old

: the old value.

•

New

: the new value.

•

Change%

: the percentage

changed per period. For example,

an 8.125% change would be

entered as “8.125”. A positive

value represents an increase while

a negative one represents a decrease.

•

Periods

: the number of periods.

Percent change set to one period and markup as a percentage of cost

are identical computations.

Profit Margin

This template performs profit margin computations:

•

Cost

: the cost to manufacture or

purchase.

•

Price

: the selling or resale price.

•

Margin%

: the gross profit

margin expressed as a percentage.

For example, an 8.125% change

would be entered as “8.125”. A

positive value represents an increase while a negative one

represents a decrease.

Profit margin and markup as a percentage of price are identical.

Sales Tax

This template performs sales tax computations:

•

Before Tax

: before tax amount.

•

Tax Rate%

: tax rate expressed as a percentage. For example, a

6% tax rate would be entered as “6”.