Doing Amortization with AMRT

QED Education Scientific

4

EXE

CMPD

0

2

EXE

7

4

EXE

5

0

(

─

)

0

EXE

0

1

EXE

2

EXE

SOLVE

1

2

AMRT

1

EXE

8

EXE

SOLVE

Doing Amortization with AMRT

The AMRT mode of 100V/200V allows user to perform amortization, which shares

many parameters/variables with the CMPD mode. In examples that follow we shall

be able to see the advantage of such ‘sharing’. Note that some amortization

problems are actually simple annuity problems which we can solve using the CMPD

mode (refer to Example 5 of

Compound Interest with CMPD

).

This first example finds the outstanding balance of a loan after certain numbers of

payment are made.

Example 1

►

>>

A loan of $5,000 is to be amortized with equal monthly payment

over 2 years at

%

7

12

=

j

. Find the outstanding principal (balance) after 8 months.

Check page E-55 of the user guide for definitions of PM1, PM2, BAL, INT, PRN,

∑

INT

and

∑

PRN. For

this example, n = 2x12 = 24,

I

% = 7, PV = -5,000, P/Y = = C/Y = 12. Other parameters = 0.

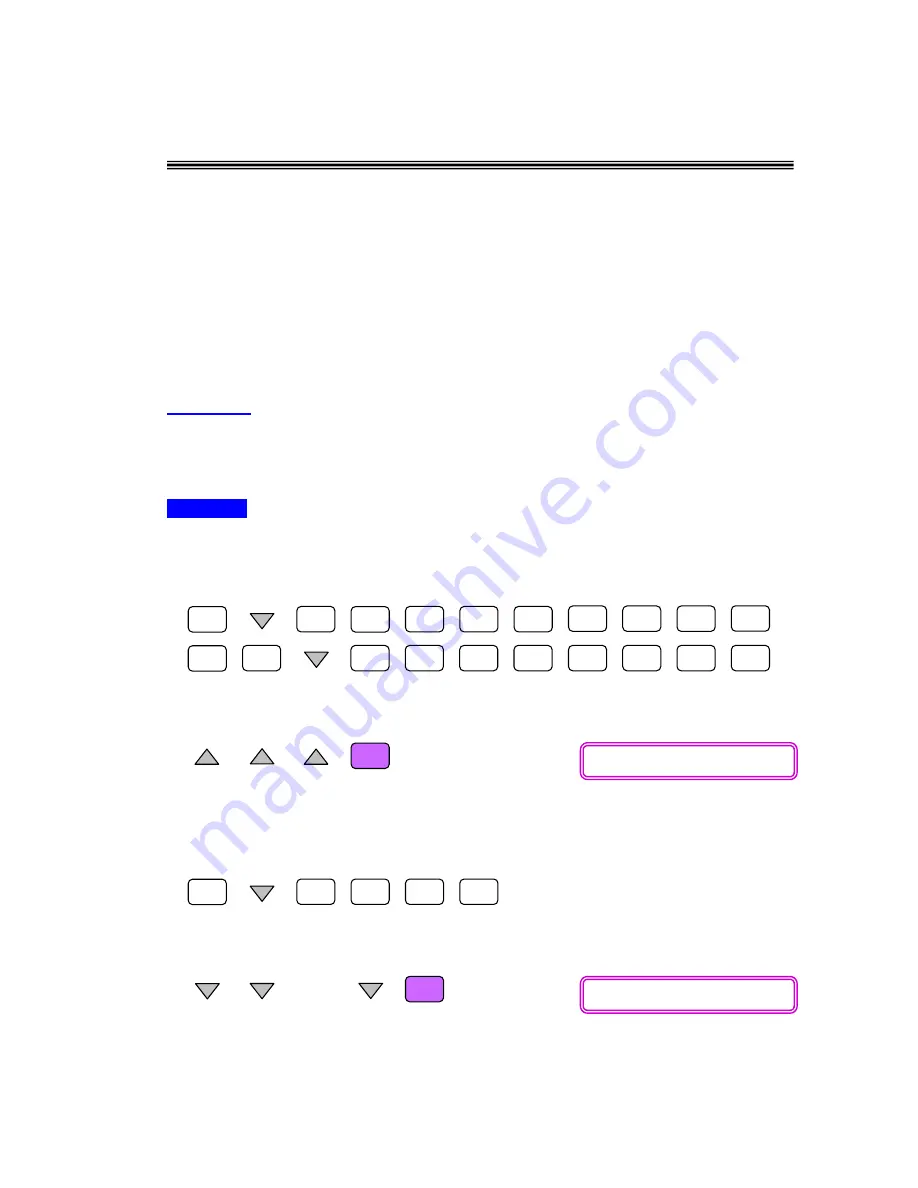

Operation

As we need to know the monthly payment of the loan, so we begin at CMPD mode.

When monthly payment is found we proceed to AMRT mode for other calculations.

Enter CMPD mode, make sure calculator displays [Set:End]. Scroll down, enter

24 for [n], 7 for [

I%

], (-)5000 for [PV], 0 for [FV], 12 for [P/Y] and [C/Y].

Now scroll up to select [PMT] and solve it.

So the monthly payment for the loan is about $223.86. Now find the outstanding

principal.

Enter AMRT mode, scroll down to enter 1 for [PM1] and 8 for [PM2].

Scroll down further to select [BAL:Solve] and solve it.

Therefore the outstanding balance after 8 payments is approximately $3410.26.

█

Output: PMT = 223.8628955

•

•

•

Output: BAL = -3410.256063