48 Mortgages and Amortization

BEAR-CH1.DOC BA Real Estate Guidebook Jackie Quiram Revised: 09/28/99 1:16 PM Printed: 09/28/99 1:16 PM

Page 48 of 36

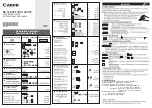

The second tax year (January through December) includes

payments 9 through 20 (12 payments).

Steps

Keystrokes

Display

Accept updated P1,

and advance to P2.

j

j

P1 =

9.00

P2 =

16.00

Enter new P2.*

20

P2

20.00

Display balance,

principal, and

interest for the

second year.

j

j

j

P2 =

20.00

BAL= 103,798.03

PRN=

-

742.90

INT=

-

9,508.82

*The calculator updates P1 to 9.00 and P2 to 16.00,

assuming that the next range is also 8 months. Changing

P2 to 20 establishes a 12-month range so the calculator can

correctly update both P1 and P2 for successive years.

The third tax year (January through December) includes

payments 21 through 32 (12 payments).

Steps

Keystrokes

Display

Accept updated P1,

and advance to P2.

j

j

P1 =

21.00

P2 =

32.00

Accept updated P2,

and display balance,

principal, and

interest for the third

year.

j

j

j

BAL= 102,984.42

PRN=

-

813.61

INT=

-

9,438.11

Note:

The worksheet on the next page omits step 1,

clearing the TVM values, due to page size restrictions.

Finding the Principal and Interest Paid

(Continued)

Solution:

Second Tax

Year

Solution: Third

Tax Year