PROGRAMMING

This chapter illustrates how to program your cash register. Program every item

necessary for your store by following the appropriate procedure.

On the key operation examples, numeric such as 1234 indicates the number or parameter which

must be entered using the corresponding numeric keys.

*1: VAT/tax rate number (1-3)

*2: Sign and VAT/tax rate: XYYY.YYYY (X:Sign -/+ = 1/0, YYY.YYYY:VAT/tax rate = 000.0001 to 100.0000)

*3: Max. five digits: 0 to 99999

In VAT system, the sign and the lowest taxable amount are ignored. They are valid only when you

select add on tax system.

Your machine is equipped with 5 (ER-A160) or 10 (ER-A180) standard departments. You can increase the

number of departments up to 15 (ER-A160) or 30 (ER-A180).

Functional programming

Sign

Assign plus department for normal sales, or minus department for minus transaction.

Tax status

Assign a tax status to each department. When entries are made into taxable departments in a

transaction, tax is automatically computed according to the associated tax rate as soon as the

transaction is completed.

SICS (Single Item Cash Sale)

If the first registration is to a department set for SICS, the sale is finalized as soon as the department

key is pressed.

Entry digit limits

Set the number of allowable digits for the maximum entry amount for each department. The limit is

effective for operations in the REG mode and can be overridden in the MGR mode.

Programming for departments

2

VAT/tax rate

Lowest taxable amount

Ñ

9

≈

2

≈

4

≈

12

Ñ É

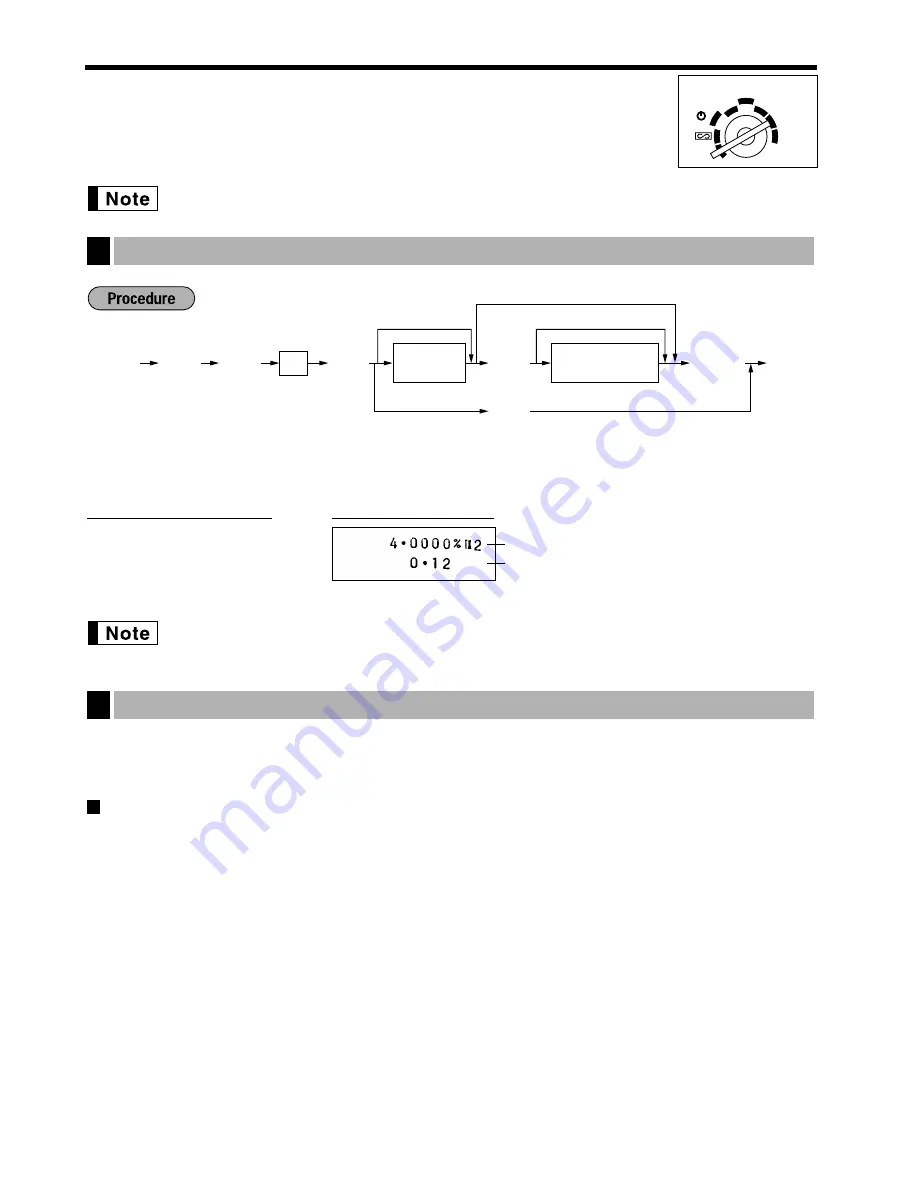

Key operation example

Programming the VAT/tax rate

1

24

≈

Ñ

*

1

A

≈

≈

?

1-3

*

2

Sign and

VAT/tax rate

*

3

Lowest taxable

amount

Ñ

É

To program "0"

To inhibit this VAT/tax rate

To program "0"

For VAT rate

9

REG

OPX/Z

MGR

PGM

X1/Z1

X2/Z2