73

Bond calculations

In its bond calculations, this calculator conforms to rules set up by

the book titled

Standard Securities Calculation Methods

, by Jan

Mayle, Securities Industry Association, 1993.

Bond calculation is based on the following rules:

1.

Whenever the redemption date happens to be the last day of a

month, coupons are also paid on the last days of months. For

example, if coupon payments are semi-annual and the redemp-

tion date is September 30, coupon payments occur on March 31

and September 30.

2.

If coupons are to be paid twice a year and the redemption date

is set to August 29, 30, or 31, coupon payments for February

occur on the 28th (29th for leap years).

3.

The “Odd Coupon” is not supported.

4.

All data stored or calculated for bonds are assumed to be posi-

tive values. Negative values in any of the variables used by bond

calculations will cause errors.

The formulas used for bond calculations are shown using the follow-

ing variable defi nitions:

TD: Total number of days in the coupon period that begins with the

coupon date previous to the settlement date and ends with the

fi rst coupon date after the settlement date. (On the 360-day

calendar, TD is 180 for semi-annual coupon and 360 for annual

coupon.)

PD: The number of days preceding the settlement date in the cou-

pon period described above. (see “Day and date calculations”)

FD: The number of days following the settlement date in the coupon

period described above (in TD).

FD = TD – PD

NP: The number of whole coupon periods between the settlement

date and the redemption date (rounded up to the next highest

whole number, if necessary).

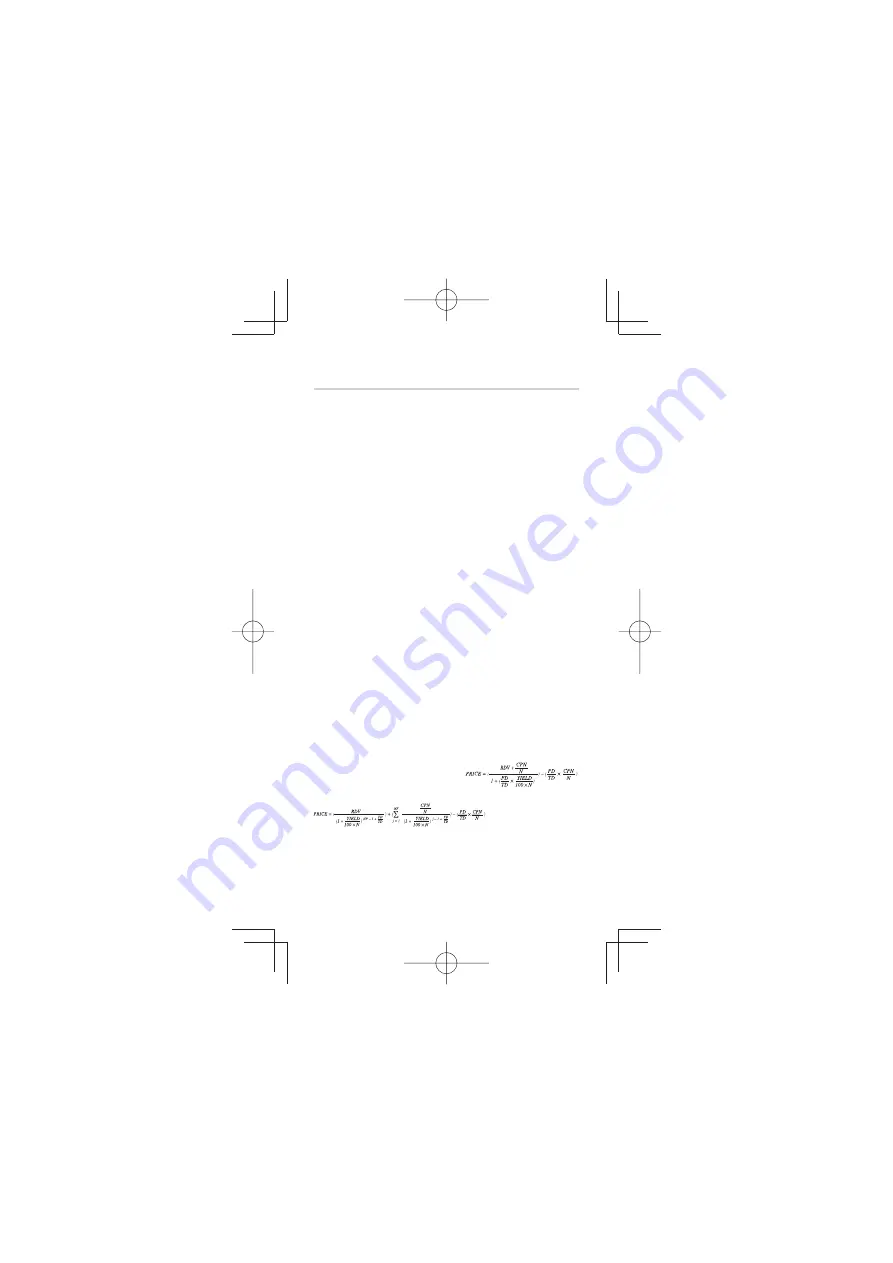

For one coupon period or less until redemption of bond:

For more than one coupon period until redemption:

where CPN = COUPON(PMT), RDV = REDEMPT(FV), N = CPN/Y(N), YIELD = YIELD(I/Y),

PRICE = PRICE(PV).

Yield is obtained as YIELD, which satisfi es the above equations.

Error

CPN < 0 or RDV < 0 or PRICE < 0 or M-D-Y 1

≥

M-D-Y 2 or YIELD

≤

–100