Office Depot Calculator –Instruction Manual

ATIVA JUMBO CALCULATOR

ITEM: OD01C

- Before operating this unit please read all instructions

- If you have any question, please call 1-877-777-4357 customer service number

-

Features/Specs

- Dual power source: solar cell & CR2032x1 (Press ” RESET” after replacing battery) battery operated

- Three lines 12 Digits with sign liquid crystal display

- Tax function/profit margin calculation

- Time show/calculation

- Change function

- Enter into time mode automatically if no key press within 6 minutes.

- Reset function

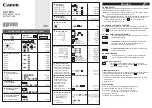

Key Functions

AC : Switch to calculator operation, clear the calculator completely

C.CE: Clear the last entry; clear the calculator completely (except independent memory)

0-9 Digit keys

00 Double zero digit input

· Dot key

+/- Sign change key

+ - × ÷ Operation keys

% Percent key

Tax+ Tax- Tax+/- keys

SET: Set the tax rate

CHANGE: Change key

COST Cost key

SELL Sell key

MGN Margin key

MRC Memory recall/ clear key

M- Memory minus key

M+ Memory plus key

Delete last digit key

Square root key

GT Grand total key

H.M.S Time calculation key

Operation key/12/24(in display time mode)

Operation key/AM/PM Key(in time setup mode)

Time display key

Operation key /Time setup key

Calculations

Calculation Type

Example

Key Operation

Display

Percentage calculation

30 x5% = 1.5

3 0 x 5 %

1.5

Extraction of square root

6

3

3

1

7

3 6 + 1 3 =

7

Chain Calculation

(6+4)x2-8

5=2.4

6 + 4 x 2 - 8

÷ 5 =

2.4

Entry correction

1234 x 2 = 2468

1 2 3 5

4

2 =

2’468

Power calculation

2

6

= 64

2 x = = x =

64

Constant Calculation

4x3=12,4x5=20

6÷2=3,8÷2=4

3+7=10,4+7=11

8-4=4,6-4=2

4 x 3 =

5 =

6 ÷ 2 =

8 =

3 + 7 =

4 =

8 - 4 =

6 =

12

20

3

4

10

11

4

2

Grand total calculation

4x3+(15-

4)+20÷2+(14+26)=73

AC

4 x 3 =

1 5 - 4 =

2 0 ÷ 2 =

1 4 + 2 6 =

GT

0

GT

12.

GT

11

GT

10.

GT

40.

GT

73.

Memory Calculation

(5x0.25)+(6x0.75)-

(2x0.15)=5.45

AC

5 x . 2 5 M+

6 x . 7 5 M+

2 x . 1 5 M-

MRC

MRC

0

M 1.25

M 4.5

M 0.3

M 5.45

5.45

Tax Calculation

Setting the tax rate as

17%

Checking the tax rate

Price at 200 plus 17%

tax:

Price after tax is

58.5,then the price and

the tax are:

AC TAX+ 1 7

TAX+

AC TAX-

AC 2 00

TAX+

AC

5 8 . 5 TAX-

TAX-

TAXRATE

17.

TAXRATE

17.

200.

TAX

34.

TAX+

234.

58.5

TAX

8.5

TAX-

50

Cost sell margin

calculation

The cost of an item

is$100 and selling price

1 0 0 COST

COST

100.

SIZE:80*120MM